By Miki Mullor

The Town of Hideout council will be discussing tentative FY24 budget. It also has notified the public of restating the FY23 budget that was “driven by fewer new subdivisions being developed and higher legal professional costs.”

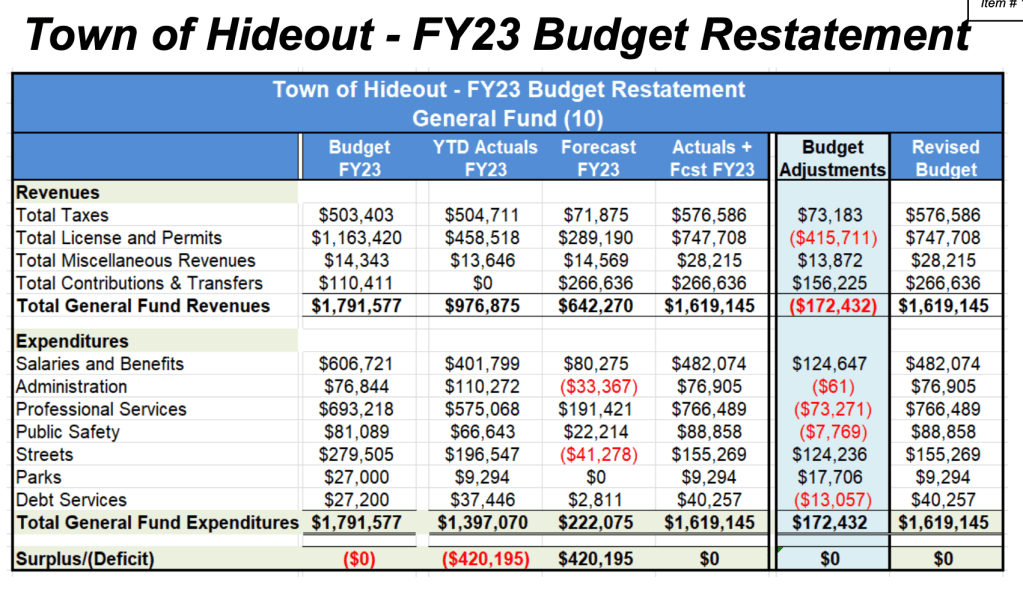

The Town is using a transfer of $156,225 from the its capital fund to close the deficit in the FY23 budget.

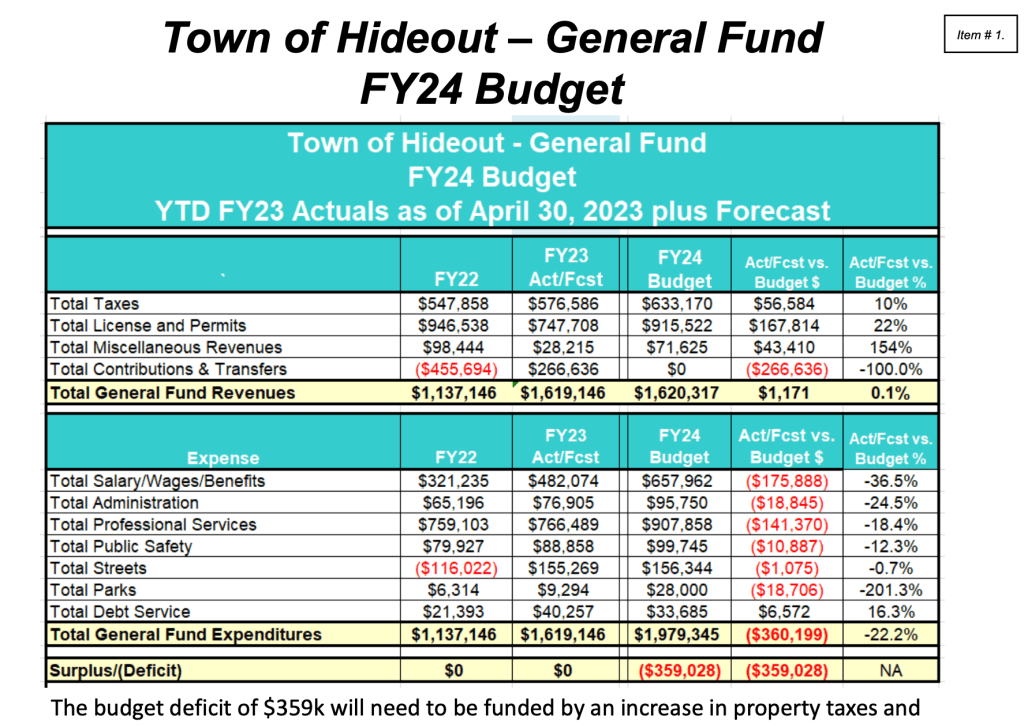

FY24 is expected to have a deficit of $455,000 that “will need to be funded by an increase in property taxes and town fees and well as continued control of town expenses and utilization of prior year capital fund surpluses.”

Lack of details

The Town is required to hold a public hearing over the proposed budget for the next fiscal year, which begins on July 1.

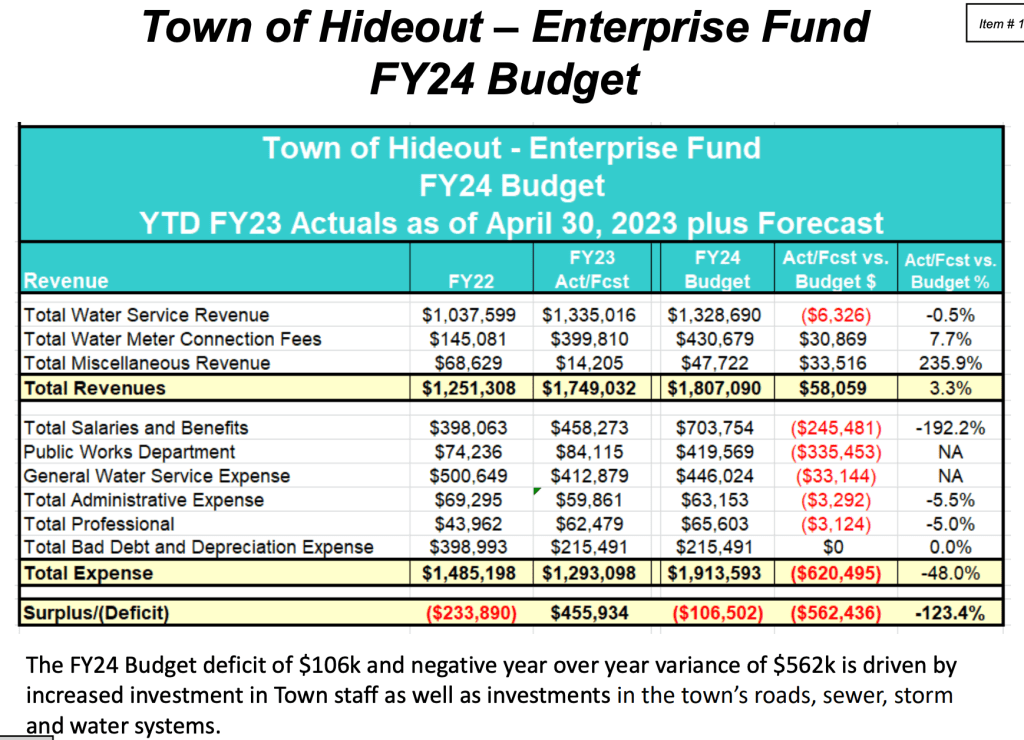

The proposed budget includes two funds: the general fund and the water enterprise fund. By Utah law, an enterprise fund is a fund that the Town collects service fees for its operation. The Town’s water fund generates revenues from water bills and water meter connection. The fee for a water meter increased this year from $1,000 to $4,500.

The Town only published the highlight summaries of the two fund’s operations, which do not include specific line items. In response to a GRAMA request for the detailed budget, the Town clerk referred the Hideout Comment to the budget notices the Town has on its website, which only include the summaries.

FY23 budget restatement

The FY23 budget restatement shows a $415,711, a 35% shortfall in License and Permits revenues compared the forecast. License and Permits represent 64% of the the general fund’s forecasted revenues.

It also shows an increase of $72,271 in professional services expenditure, which includes legal and engineering. It is not possible to tell from the summary how much of the increase is due to legal expenses given that lower permitting activity could also have reduced engineering expenses, associated with building activity.

FY24 anticipates Golden Eagle activity to resume

The FY24 budget for the general fund includes another increase in professional services expenses of $141,000 to a total of $907,000, an 18% increase. It is unclear from the summary how much of that is due to legal costs. Professional services is now 45% of the general fund’s expense. Public safety (police), parks and street line item expenditure in total is $283,000, 14% of the fund’s total expenses.

Revenue is expected to rise due to a “27% building permit increase (83 to 105) – 6.5% increase over FY23 – plus release of Golden Eagle building permits” – per the Town’s report, signaling perhaps a near ending to the Town’s denial of building permits in Golden Eagle, a denial which was held illegal by a judge on May 1.

Some of the operating expenses seem to have been offloaded to the water enterprise fund, which carries an additional $106,000 deficit. It is unclear from the summary the Town provided for the public hearing how much of the water fund expenses actually belong to the operation of the water services or whether those are actually general fund expenses.

Public hearing schedule

The statutorily required public hearing will be held on June 8.

Tonight’s discussion is open to the public to listen, however the Town limits public comment to discussing items that are not on the agenda.

Hmmm, maybe the town should support the development they do have and driving up their own legal fees while losing property taxes and values. ???

LikeLike

Self inflicted wound – – no worries property owners bear the brunt. I say property owners since becoming a house owner in Hideout under its current leadership is next to impossible….

LikeLike

It sure appears like the Town of Hideout and Bob Martino have a long running axe to grind against each other, and they want the property owners to pick up the tab. These two need to grow up and get this worked out like now. This isn’t ok.

LikeLike